IVM - M'Pherson

|

IVM - M'Pherson |

|

|

Articles | Books | Dictionary | Faq | Home | Leaders | Organizations | Search

|

Inclusive Value Measurement |

Summary of M'Pherson's IVM. Abstract |

© / ™Professor P.K. M'Pherson |

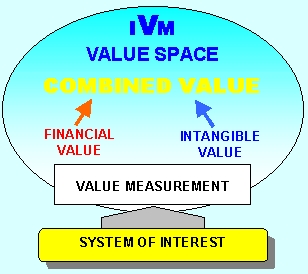

Managing and integrating diverse sources of value

IVM stands for Inclusive Value Measurement. IVM breaks new ground to take value streams over and above financial ones. This allows Inclusive Value Measurement to provide a way to manage and integrate diverse sources of value. With Inclusive Value Measurement, all aspects of value can be measured, combined, integrated and managed, including intangible assets and processes - in a way that is valid and reliable.

Inclusive Value Measurement can be used to:

Optimize Value for Money for businesses, services and projects

Manage Cost-Benefit Analysis and Life-cycle Cost-Effectiveness design projects

Account properly for Intangible Value, such as: Intellectual Capital, Reputation and Information

Establish the monetary equivalent of value contributions accruing from Intangible Assets

Provide a modeling environment for Strategic Decision-making and Complexity Management

Conduct and visualize complex trade-offs between costs and benefits

Act as a valid measuring instrument for Business Value

Valuing Intangibles

Intellectual Capital

| 👀 | TIP: On this website you can find much more about Inclusive Value Measurement! |

Edvinsson, Corporate Longitude

Kaplan, Norton, The Strategy- Focused Organization

Standfield, Intangible Management

Lev, Intangibles: Management, Measurement, and Reporting

Smith, Valuation of Intellectual Property and Intangible Assets

Try also: Kaplan Norton Balanced Scorecard Edvinsson Intellectual Capital Intangibles Valuation Valuing Intangibles Baruch Lev Managing for Value Shareholder Value Stakeholder Value

About us | Advertise | Privacy | Support us | Terms of Service

©2023 Value Based Management.net - All names tm by their owners